Increasing Volatility: Prelude To a Crash?

The megaphone pattern in the U.S. stock market typically presages a major decline or full-blown crash.

Market observers have long noted that increasing volatility presages market crashes. If you glance at a chart of September-October 1929, just before the crash that started the Great Depression, you will note the same sort of manic swings of euphoria and fear that have characterized the U.S. stock market over the past few months.

Not only are the swings increasing in amplitude, the time between each move up or down is decreasing. Think of a series of wind storms that grow increasingly more violent even as the time between storms diminishes.

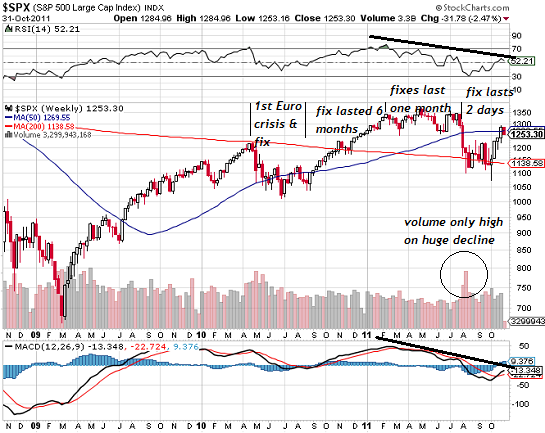

In stock charts, this widening of range traces out a megaphone pattern. The S&P 500 (SPX) has traced out a classic megaphone pattern over the past few months:

Note the eleven wild swings up and down in a mere two months. Does anyone seriously believe this sort of schizophrenia typifies a healthy Bull market?

From a technical point of view, the recent euphoric three-week rally is nothing but a last-gasp attempt to regain the critical 200-day moving average (MA), another classic sign of a market about to roll over big-time.

On the weekly chart, we can clearly see how the timespan between official "fixes" and renewed declines has shrunk from six months from the first "fix" in May 2010 to two days after the last "grand fix." Market participants are losing faith in the Status Quo's ability to effect a coherent, lasting "fix," especially as the rules governing hedges such as CDS are changed at will.

Last week I reprinted this chart from The Chart Store of the uncanny similarity of the current market to the 1907 crash. Notice the "secondary" crash that occurred right about now in the 1907 chart; history doesn't repeat exactly, and analog charts are not predictions, but it is certainly interesting how recent action has closely matched the 1907 price movements. Were the present to continue following the basic outlines of the older chart, this targets an SPX level around 900.

In the real long-term, one target for the SPX is around 600. "Impossible," Bullish observers say. Perhaps. But all sorts of "impossible" things seem to have happened in the past four years, and the line between what's "impossible" and possible has blurred.

Technically, a re-test of the March 2009 lows around 666 is certainly possible, despite protestations to the contrary.

If this recession strikes you as different from previous downturns, you might be interested in my new book An Unconventional Guide to Investing in Troubled Times (print edition) or Kindle ebook format. You can read the ebook on any computer, smart phone, iPad, etc.Click here for links to Kindle apps and Chapter One. The solution in one word: Localism.

My Big Island Girl (song) Buy fromCD Baby or amazon.com (99-cent MP3 download)

Readers forum: DailyJava.net.

My new book is available in both print and ebook formats: An Unconventional Guide to Investing in Troubled Times (print edition) or Kindle ebook format. You can read the ebook now on any computer, smart phone, iPad, etc. Click here for links to Kindle apps and Chapter One.

Order Survival+: Structuring Prosperity for Yourself and the Nation (free bits) (Mobi ebook) (Kindle) or Survival+ The Primer (Kindle) or Weblogs & New Media: Marketing in Crisis (free bits) (Kindle) or from your local bookseller.

Of Two Minds Kindle edition: Of Two Minds blog-Kindle

| Thank you, Mary D. ($25), for your extremely generous contribution to this site -- I am greatly honored by your support and readership. | Thank you, Bogdan C. ($50), for your marvelously generous contribution to this site -- I am greatly honored by your support and readership. |